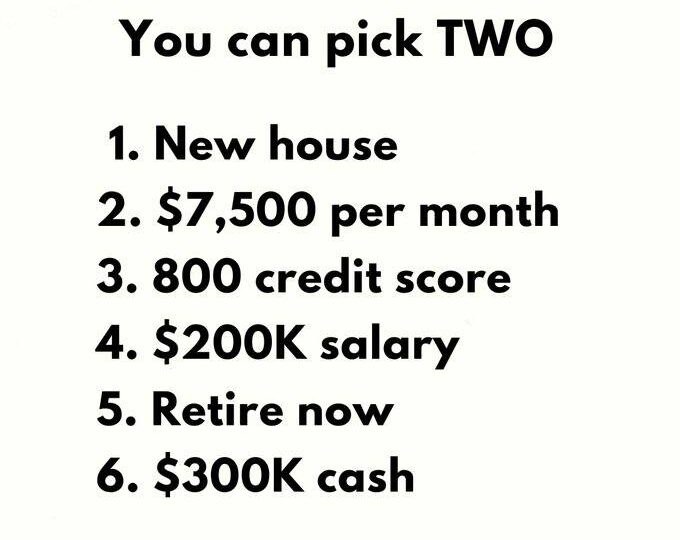

The Major Decision: Which Two Would You Select?

Life often presents us with pivotal decisions that can significantly influence our future. Picture being given six appealing choices, each offering a distinct path toward financial freedom, stability, or luxury. The challenge? You can only select two. Here’s a closer look at each option and its potential impact on your life:

New Home Acquiring a new home represents more than just acquiring a living space; it’s a step toward long-term stability. Homeownership offers a sense of achievement and the potential for property value appreciation. Real estate can be a valuable asset, passed down through generations or sold for profit. Yet, it also comes with responsibilities like maintenance, property taxes, and market fluctuations.

$7,500 Monthly Income An additional $7,500 per month can provide considerable financial flexibility. This income could cover most of your expenses, allowing for savings, investments, or discretionary spending. It can help reduce debt, build an emergency fund, or enable indulgences previously out of reach. However, consider how this income aligns with your long-term financial plans and whether it provides the stability or security you need.

800 Credit Score A credit score of 800 opens doors to the best loan terms, top-tier credit cards, and favorable rental or job opportunities. Although it doesn’t offer immediate cash, an excellent credit score can save substantial amounts in interest and grant access to opportunities others might not have. However, credit scores are developed over time, so weigh this option against more immediate financial needs.

$200,000 Annual Salary A $200,000 annual salary is a substantial amount, providing the potential for a comfortable lifestyle, significant savings, and robust investments. However, high salaries often come with increased work demands, longer hours, and heightened expectations. It’s important to evaluate if the job satisfaction and security associated with this salary outweigh the potential impact on your work-life balance.

Immediate Retirement The option to retire immediately is alluring, particularly if you’re feeling overwhelmed. It offers the freedom to explore passions, travel, or relax without the constraints of a regular job. However, retiring early requires meticulous planning to ensure your savings support your lifestyle throughout retirement. Consider whether you’re ready, both financially and mentally, for such a major transition.

$300,000 Cash A cash sum of $300,000 can be transformative. It can serve as a down payment for property, investment capital, or an emergency fund. The versatility of cash allows you to tailor its use to your immediate needs. Nonetheless, having a strategy for utilizing this money wisely is essential to ensure it provides lasting benefits rather than being quickly depleted.

Which Two Will You Choose? Ultimately, the decision hinges on your current circumstances, aspirations, and values. Are you seeking immediate financial relief, long-term security, or the freedom to follow your dreams? There is no definitive answer—only the choices that best align with your vision for the future. Reflect on your priorities and decide which two options will best support your goals and happiness.